Ingest deal and company data to build a living knowledge base — then power diligence, research, reporting, and portfolio operations across the investment lifecycle

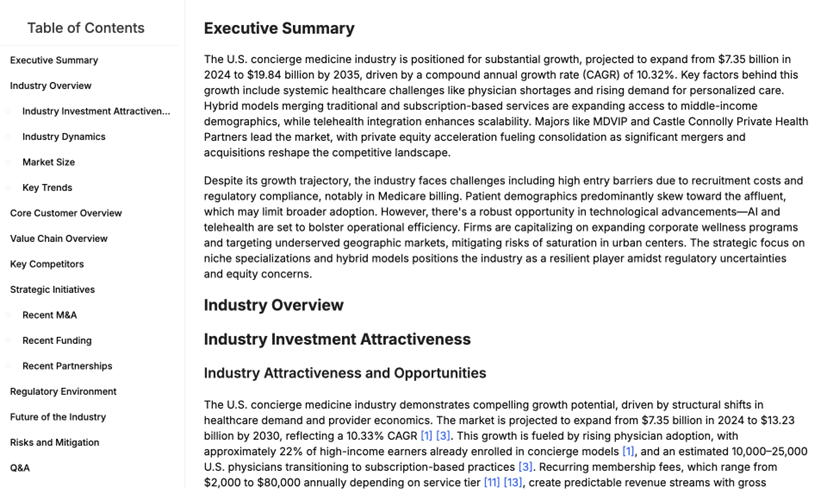

Generate Custom Market Overviews in Minutes

Input any industry — and let Lumenai’s Industry Agent compile a tailored analysis using your inputs and external sources such as PitchBook, CapIQ, and Tegus transcripts, and others. Get data-backed trends, benchmarks, and competitive landscapes — all in a concise, ready-to-share report.

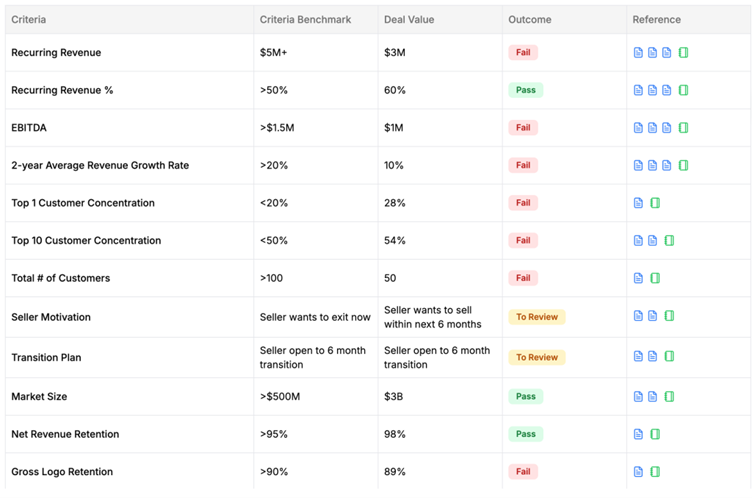

Identify the Right Opportunities Faster

Upload CIMs, teaser decks, or financials — and let Lumenai’s Screening Agent assess each opportunity against your team’s specific investment criteria. See clear pass/fail signals, key metrics, and rationale, so you can prioritize only the deals that truly fit your mandate.

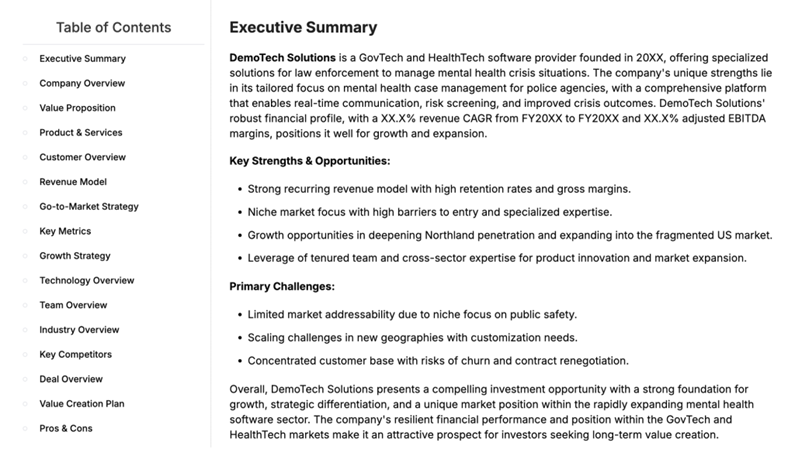

Auto-Generate Investment Memos From Your Sources

Upload your diligence materials and notes — Lumenai synthesizes the key takeaways into investor-grade deal memos.

Fully customizable sections, consistent formatting, and AI-backed insight generation.

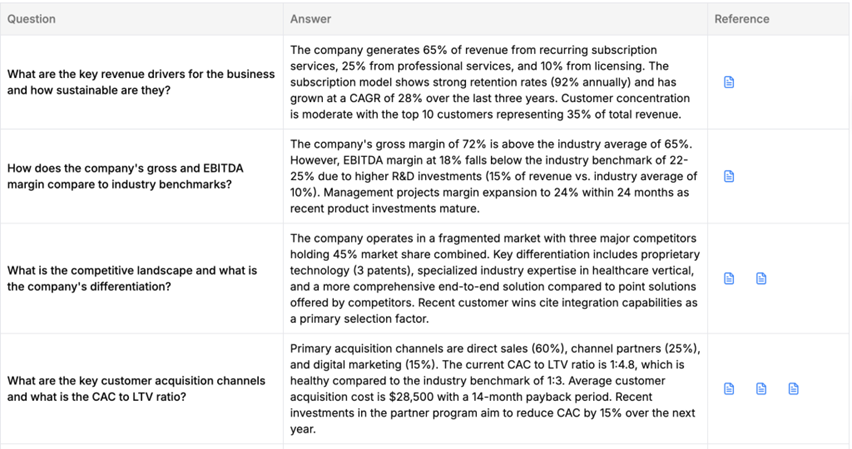

Turn Diligence Questions Into Instant Answers

Upload your sources — CIMs, data rooms, expert transcripts — and let Lumenai’s Q&A Agent auto-generate accurate, data-backed responses for buyers or sellers.

Save hours in every diligence cycle and retain a single source of truth.

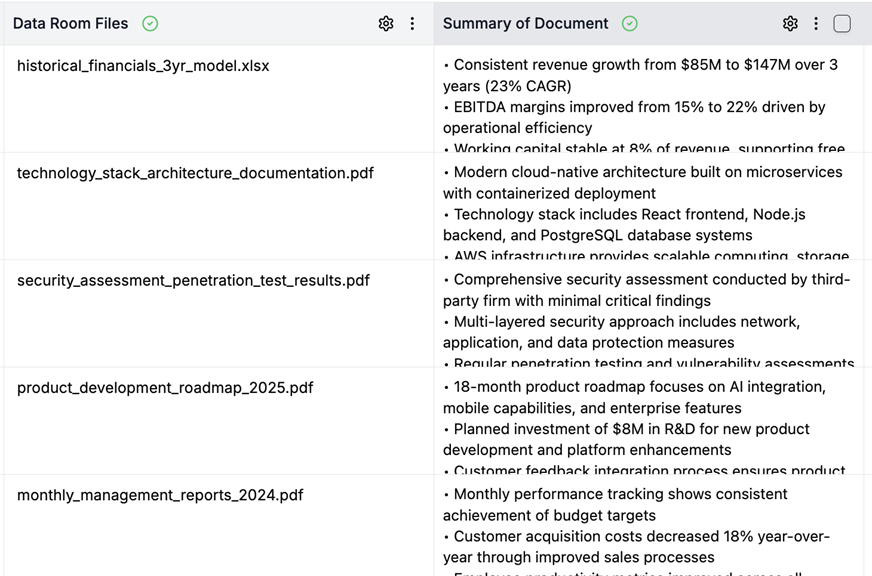

Instantly Understand Every File in the Data Room

Upload your entire data room — Lumenai automatically reads, summarizes, and connects insights across every document. Ask any question about the contents, and get precise, data-backed answers in seconds — without having to open each individual file.

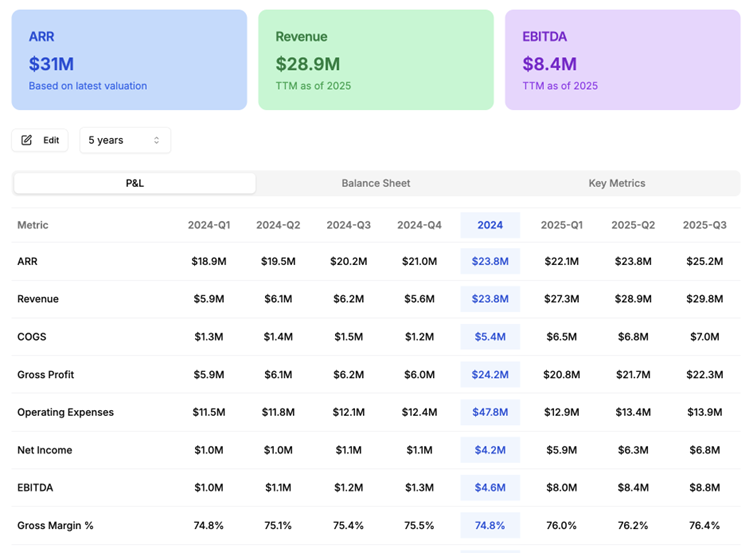

Real-Time Visibility Across Every Investment

Lumenai automatically consolidates financials and KPIs from your portfolio companies into a unified dashboard.

Spot trends, track performance variance, and generate investor-ready reports — all from one place.

Create Investor-Ready Portfolio Overviews Instantly

With your data already centralized in Lumenai, instantly generate polished overviews for each company and the full portfolio.

Deliver consistent, insight-rich reports to LPs — automatically formatted and ready to share.

Create custom workflows tailored to how your team operates.

From due diligence to portfolio monitoring and reporting, configure automations that reflect your exact processes — and evolve as your firm grows.

.png)

.png)

Streamline Diligence and Portfolio Value Creation

.png)

Automate data-room parsing, buyer Q&A, and deal memo generation

Monitor portfolio KPIs and valuations in one connected dashboard

Save time across diligence and reporting cycles through centralized automation

Simplify Borrower Monitoring and Compliance

.png)

Ingest and summarize borrower financials automatically

Track covenants, risk metrics, and loan performance in one workspace

Generate audit-ready credit and compliance reports instantly

.png)

Automate Portfolio Tracking and Valuations

.png)

Centralize updates from portfolio companies and reporting tools

Monitor portfolio KPIs and valuations in one connected dashboard.

Eliminate manual data collection across dozens of early-stage holdings

.png)

Accelerate Deal Execution and Streamline Post-LOI Processes

.png)

Automatically summarize entire data rooms and key documents

Generate fast, accurate answers to buyer or internal diligence questions

Create consistent, insight-driven deal overviews for every transaction

.png)

Create a Unified Source of Truth for all Performance Data

.png)

Establish a single, reliable source of truth for performance metrics

Streamline investor reporting and valuations with audit-ready data flows

Simplify internal reporting and board prep with connected financials and KPIs

.png)

Accelerate Client Diligence With Automated Research and Insights

.png)

Generate expert call guides and targeted survey questions in seconds

Synthesize findings into clear, client-ready presentations

Deliver faster, sharper insights — without the manual work

.png)

.png)

.png)

.png)

.png)